When insurance expires, policyholders face significant risks, including potential financial loss from uncovered damages or liabilities. Without active coverage, any incidents such as accidents or property damage may result in hefty out-of-pocket expenses. And another thing, lapses may lead to increased premiums or difficulties in securing new coverage. To mitigate these risks, it’s crucial to review policy dates proactively, renew coverage in advance, & consider transitional insurance solutions to bridge gaps. Regular communication with insurance providers can also help navigate risks & ensure continuous protection.

What Happens When Insurance Expires? Understand the Risks & Solutions. What happens when your insurance expires? Discover the risks you face & explore smart solutions to stay protected without gaps.

Understanding Insurance Expiration

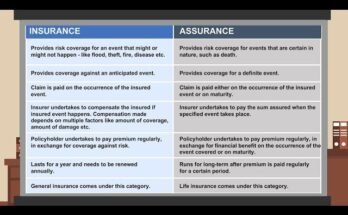

Every policyholder must recognize that once an insurance policy expires, a plethora of ramifications can unfold. Different types of insurance come into play, including auto, health, life, & property insurance. Awareness regarding potential risks associated with expired coverage is crucial. Whether required by law or personal choice, maintaining adequate insurance safeguards against unforeseeable mishaps. Having experienced a lapse in coverage myself, I understand well how critical it becomes for an individual or business not only to comprehend potential downsides but also active solutions that can preempt further issues.

Potential Risks of Expired Insurance

Firstly, one significant risk associated with expired insurance pertains to financial liability. Without active coverage, individuals or businesses may find themselves responsible for all expenses resulting from accidents, thefts, or any unforeseen incident. This financial burden can prove overwhelming for many, leading individuals into dire situations. On top of that, if an individual operates a vehicle with expired insurance, not only does this breach legal obligations, but it also opens them up to hefty fines or penalties.

Another risk involves legal ramifications stemming from an expired policy. Many states enforce strict regulations requiring specific types of insurance, notably auto insurance. Operating without legal compliance can result in court appearances, increased insurance premiums, &, at times, even license suspension. Individuals should remain mindful of local legislation that dictates insurance requirements, as failure could have severe consequences.

And another thing, one must consider health insurance expiration. A lapse here may lead to losing access to necessary healthcare. Patients without active coverage face delays in treatment & substantial medical bills. Without adequate protection, receiving medical attention could become an insurmountable hurdle, especially for those dealing with chronic conditions. Overcoming these risks requires individuals proactively managing coverage dates.

Consequences of Letting Insurance Policies Lapse

Letting insurance policies lapse serves consequences that can extend beyond immediate financial ramifications. Individuals face an elevation in future premiums should they allow a policy to expire. Insurance companies often view lapses as a sign of increased risk, thus recalibrating quotes based on this new risk assessment. A history of gaps in coverage suggests possibilities of unreliability, consequently making obtaining new coverage more challenging.

And don’t forget, businesses allowing necessary coverage to lapse may encounter interruptions in operations. Many companies require insurance for contractual obligations, & any lapse could hinder current & future contracts. Supply chain disruptions may occur, damaging business relationships & overall reputation within respective industries.

Then, there exists a social consequence surrounding expired insurance. A missed premium payment can often lead to feelings of guilt or anxiety, particularly if an incident occurs, leading affected individuals down an emotional spiral. This psychological burden can impact daily living & even personal relationships, highlighting another facet of expired insurance consequences.

Why Policies Expire

Insurance policies generally have defined expiration dates, leading many to overlook renewal processes. Factors contributing to policy expiration include missed payments, changes in policyholder circumstances, or policy restructuring. A change in personal situations, such as marriage or divorce, may necessitate re-evaluating coverage. Individuals must proactively manage policies to circumvent lapses in coverage.

In today’s economic climate, financial hardship also plays a vital role in determining whether individuals maintain active insurance. With increasing costs of living & financial constraints, some may prioritize immediate needs over long-term risks. This short-sightedness often results in a lapse, only to later realize critical coverage shortfalls in times of need.

And another thing, insufficient understanding of policies can contribute to unintentional expirations. Many individuals may not fully grasp their policy terms or renewal processes. This lack of clarity increases the likelihood of missing payment deadlines, subsequently causing policy expirations. Consumers should educate themselves concerning every insurance policy they hold, ensuring comprehensive understanding.

Available Solutions for Non-coverage Periods

Recognizing solutions to manage non-coverage periods can empower individuals & businesses alike. Seeking immediate communication with an insurance provider often serves as a first step. Most companies offer grace periods for overdue payments, allowing policyholders to reinstate coverage without extensive complications. Customers should promptly contact their insurance provider, explaining their situation.

On top of that, individuals should look into alternative coverage options. Many insurers provide temporary coverage plans, which can cover gaps in regular policies while allowing consumers to assess long-term needs. This flexibility can ease anxieties related to lapses while ensuring critical protections remain in place.

Some may also consider enrolling for insurance through group policies or employer coverage. These options typically allow individuals to gain necessary protections without excessive financial burden. Even if individual policies experience lapses, many organizations offer access to affordable group rates & benefits. Such initiatives should be actively pursued to maintain coverage consistently.

Importance of Timely Renewal

Maintaining coverage requires diligence in renewing active policies. Proactive renewal involves tracking expiration dates & setting reminders. Implementing calendar alerts, either physically or digitally, can serve as beneficial tools. And another thing, it remains vital to regularly review policy terms & conditions. As personal situations change, so do coverage needs, thereby requiring appropriate alterations.

Another avenue involves staying informed about changes within insurance regulations & market trends. Regulatory shifts can affect required coverage levels, which may necessitate comprehensive policy reviews. Understanding potential changes empowers individuals when negotiating renewals. On top of that, familiarity with competitive pricing helps consumers make informed decisions in an increasingly complex market.

Finally, leverage technology & resources available online for reminders & educational content. Many insurance platforms now offer online access to accounts where individuals can manage payments, view policy details, & even receive alerts before expiration. Utilizing these resources can significantly enhance knowledge & improve chances of maintaining continuous coverage.

Reinstating Expired Insurance Policies

Reinstating expired insurance policies can become complicated, yet many insurers provide pathways for returning customers. Begin by contacting an insurance provider to discuss potential options for renewing expired policies. Some insurers may be willing to reinstate coverage without excessive penalties, particularly if lapses involve minor delays in payment.

In some scenarios, insurers might require the policyholder to undergo a new underwriting process. This could include filling out fresh applications, sometimes leading to increased premiums. Individuals should remain prepared for changes in premium rates, taking historical years of coverage into consideration.

And another thing, conducting research concerning available replacements for expired policies may be beneficial. Various insurers may offer promotions or unique benefits for new customers. Exploring options can open new doors for affordability while ensuring continuous protection remains a priority.

Comparing Insurance Options Post-expiration

After experiencing a policy expiration, comparing available insurance options becomes critical. Information gathering entails researching multiple insurers, obtaining quotes, & understanding coverage differences. Consumers often have diverse needs, thus emphasizing the importance of thorough research. Platforms offering comparison tools can simplify this process, providing an easier way for consumers to identify suitable coverage.

In this assessment phase, policyholders must analyze coverage limits as well as exclusions to ensure adequate protection. Understanding detailed differences in terms & conditions promotes informed decision-making. And don’t forget, individuals should leverage specific scenarios that may necessitate increased coverage, such as life events or potential business expansions.

Also, don’t overlook customer service reputations while selecting among insurers. A company’s responsiveness & customer service quality often dictate how smooth claims processes manifest. Researching online reviews or seeking recommendations from acquaintances can reveal invaluable insights valuable during selection.

Transitioning between Types of Insurance

Transitioning between different types of insurance can often bring forth complexities, yet remaining attentive to details ensures seamless changes. Whenever individuals shift from one type of coverage, they must maintain simultaneous policies, preventing lapses throughout. For example, switching auto insurance providers should happen while maintaining active coverage with a new policy before discontinuing the previous one.

Education concerning supplementary coverages also remains pivotal. Policies such as umbrella or renters insurance may provide additional layers of security amidst transitions. Evaluating all potential coverages within a personal or business portfolio can dictate how gaps in coverage are handled during transitions. Proactive management significantly enhances overall risk management & reduces financial exposures.

Finally, understanding how state regulations impact transitions must not fall by the wayside. Some states regulate insurance coverage mandates that affect how policies are acquired, maintained, & switched out. Knowledge of local laws fosters compliance & shields individuals from potential legal & financial repercussions.

Real-Life Experiences with Expired Insurance Coverage

Having faced an episode with expired health insurance, I fully understand risks & distress associated with such situations. In a moment when health services became necessary, lack of coverage amplified anxiety considerably. Without active insurance, seeking treatment turned challenging, leading not only to additional costs but overwhelming emotional strain. This experience emphasized how crucial insurance maintenance remains for everyone.

On another occasion, a close friend encountered hurdles after permitting auto insurance to lapse. Receiving a traffic citation for not having active coverage resulted in penalties & increased insurance rates, thus making their financial situation more complicated. This unfortunate event pointed out significant repercussions one may face due solely to missed deadlines.

These personal accounts underline importance of staying vigilant in managing insurance. Ensuring that coverage remains continuous ensures peace of mind, enhancing overall quality of life. Individuals must prioritize diligence concerning their policies & stay aware of expiration dates.

See Below for Insights on Risks & Solutions

- Increased Financial Liability

- Legal Ramifications & Penalties

- Risk of Losing Access to Healthcare

- Future Higher Premium Rates

- Impact on Business Operations & Contracts

Key Takeaways for Handling Insurance Lapses

- Communicate Promptly with Providers

- Seek Temporary Coverage Options

- Educate Yourself on Policy Requirements

- Set Calendar Reminders for Renewals

- Consider Group Insurance via Employers

Comprehensive Overview on Insurance Needs

| Type of Insurance | Common Expiration Risks | Solutions |

|---|---|---|

| Auto Insurance | Legal penalties, accident liability | Immediate communication with providers |

| Health Insurance | Lack of access to medical services | Explore temporary or group coverages |

| Life Insurance | Increased premiums upon reapplication | Consult financial advisors |

Considerations for Future Insurance Strategy

When realizing potential ramifications associated with expired policies, establishing proactive measures becomes fundamental. Consumption of comprehensive insurance coverage promotes stable financial situations. Clients should regularly assess needs while acknowledging how external influences impact their strategies.

On top of that, seeking professional guidance can enrich decision-making processes, ensuring appropriate coverage matches specific needs. Financial advisors specializing in insurance can provide invaluable insights or recommendations tailored according to personal circumstances.

In this evolving landscape of insurance, continuous engagement & education remains essential. Individuals must take responsibility to nurture peace of mind while safeguarding assets. Understanding implications surrounding insurance expiration will undoubtedly lead towards more informed choices within a singular insurance journey.

Conclusion

When your insurance expires, it leaves you open to various risks, like hefty bills & unexpected losses. You might find yourself in tough situations without the coverage you thought you had. It’s essential to regularly check your policy’s status & renew it on time. If your insurance coverage lapses, look into solutions like short-term plans or compare rates for new policies. Remember, staying protected is better than facing challenges unprepared. Understanding what happens when your insurance expires is crucial for your peace of mind & financial security. Don’t wait take action before it’s too late!