In 2023, the insurance industry is reshaping itself through key trends such as increased adoption of artificial intelligence for claims processing, the rise of personalized insurance products driven by data analytics, & the emphasis on sustainability with green insurance policies. Cybersecurity remains paramount as digital risks grow, prompting insurers to enhance coverage options. And another thing, the shift towards telematics & usage-based insurance is redefining customer engagement & pricing models, while regulatory changes demand greater transparency & consumer protection, making it essential for insurers to adapt swiftly to these evolving dynamics.

Top 2023 Trends Shaping the Insurance Industry: What You Need to Know. Discover the top 2023 trends in the insurance industry that you need to know. Stay informed & ready for the future of insurance!

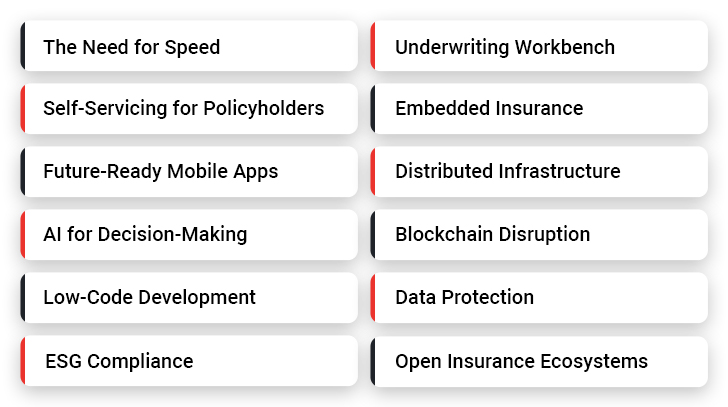

Digital Transformation in Insurance

Recent years have witnessed a remarkable shift toward digital transformation in various industries, with insurance being no exception. Adapting technologies such as Artificial Intelligence (AI), machine learning, & blockchain offers opportunities previously unheard of in this sector.

Insurance companies are striving to improve efficiency, reduce costs, & enhance customer experiences through digital means. This shift often entails using online platforms to handle customer inquiries, claims processing, & even underwriting effectively bridging gaps between traditional practices & modern consumer expectations.

As a personal experience, I have witnessed how digital tools can streamline operations within my own interactions with insurance companies. Instead of enduring long waits for assistance, accessing information online has resulted in quicker resolutions. Awareness surrounding digital transformation continues expanding among consumers, who increasingly seek convenience & transparency.

Key Aspects of Digital Transformation

- Artificial Intelligence enabling smarter underwriting processes.

- Automation of repetitive tasks to improve operational efficiency.

- Blockchain ensuring increased security in transactions.

- Cloud computing facilitating better data management.

- Mobile applications providing easy access for customers.

Customer-Centric Approaches

In 2023, a pronounced movement toward customer-centric approaches within insurance realm attracting considerable attention. With consumers becoming increasingly demanding, companies must prioritize understanding needs & preferences. This customer-first mentality seeks not only to provide exceptional service but also to build lasting relationships.

By leveraging data analytics, companies can gain insights into consumer behavior, enabling them to tailor offerings accordingly. For instance, personalized policies or coverage options become more prevalent, allowing consumers greater satisfaction & loyalty towards their preferred providers.

Strategies for Enhanced Customer Experience

- Utilizing data analytics for personalized marketing.

- Creating user-friendly online platforms for policy management.

- Engaging customers through social media channels.

- Implementation of chatbots for 24/7 support.

- Conducting regular feedback loops to gather consumer insights.

Regulatory Changes & Compliance

As insurance industry evolves, navigating regulatory changes remains a crucial challenge. Increased scrutiny from regulatory bodies aims at consumer protection, fraud prevention, & maintaining market stability. Adapting to these changes requires proactive measures from insurers.

Companies must remain vigilant about compliance, ensuring that policies, procedures, & practices align with new regulations. Failing to do so risks hefty fines or reputational damage. Continuous professional development & training for staff members become essential components of successful compliance strategies.

Key Regulatory Considerations

- Increased emphasis on data privacy & protection regulations.

- New guidelines surrounding claims handling processes.

- Potential changes in tax regulations affecting policies.

- Heightened scrutiny regarding anti-money laundering practices.

- Adaptation to evolving consumer protection laws.

Insurance Market Trends

Several emerging trends significantly shape direction of insurance market today. Understanding key changes not only informs companies but also empowers consumers when making decisions regarding coverage & providers.

Market dynamics undergo constant fluctuations, influenced by external factors ranging from economic conditions to technological advancements. Identifying trends within this space helps businesses anticipate shifts in consumer demand, adjust offerings accordingly, & remain competitive.

Current Notable Market Trends

- Increased interest in usage-based insurance models.

- Growing number of partnerships between insurers & tech firms.

- Expansion of micro-insurance products targeting underserved markets.

- Emergence of insurtech disruptors challenging traditional models.

- Enhanced focus on environmental, social, & governance (ESG) factors.

Emergence of Insurtech

As a growing force within industry, insurtech reshapes how insurance products are developed, delivered, & serviced. Startups harnessing technology drive innovation & challenge long-established business models. Their approach emphasizes agility, speed, & advanced technological integration.

Many traditional insurers collaborate with insurtechs, recognizing benefits stemming from such partnerships. This collective approach allows established companies access to cutting-edge technology while providing startups with industry expertise.

Key Drivers of Insurtech Growth

- Rapid development of advanced technologies.

- Increased investment in insurtech space.

- Growing consumer expectations for seamless digital experiences.

- Regulatory support for innovation within insurance sector.

- Data accessibility enabling tailored product offerings.

Cybersecurity & Risk Management

Insurance industry faces heightened risks associated with cyberattacks, making cybersecurity a pivotal trend. As companies digitize operations, ensuring data integrity & protection against threats become paramount. Insurers must implement robust cybersecurity measures while simultaneously offering coverage solutions that mitigate risks for policyholders.

Consumer trust hinges on companies providing adequate safeguards against potential breaches. And don’t forget, educating clients about these risks proves essential in creating a culture of awareness around cybersecurity practices.

Critical Cybersecurity Considerations

- Investment in advanced security technologies.

- Training staff on cybersecurity protocols.

- Regular audits & assessments for vulnerabilities.

- Collaboration with cybersecurity firms for expertise.

- Consumer education programs focused on safe practices.

Data Analytics & Business Intelligence

Utilizing data analytics proves transformative within insurance realm, enabling companies to derive actionable insights from vast troves of information. Implementing effective business intelligence solutions allows insurers to make informed decisions regarding risk assessment, pricing strategies, & customer engagement.

By harnessing analytics tools, businesses can identify trends, predict future claims, & enhance underwriting processes. Ultimately, this leads to improved profitability while simultaneously providing clients with better-targeted policies.

Key Benefits of Data-Driven Strategies

- Enhanced risk assessment through predictive modeling.

- Improved customer segmentation for targeted marketing efforts.

- Operational efficiency gained through streamlined processes.

- Business growth facilitated by identifying new opportunities.

- Competitive advantage derived from leveraging data insights.

Environmental & Social Responsibility

There exists a growing emphasis on environmental & social responsibility within insurance sector. Consumers increasingly prefer companies demonstrating commitment towards sustainable practices. Insurers must align their business models with evolving consumer values.

Ensuring that products promote environmental sustainability & social equity can enhance brand loyalty. Businesses need to explore opportunities for integrating sustainability into operations without compromising profitability or core offerings.

Strategies for Sustainable Practices

- Developing eco-friendly insurance policies.

- Investing in renewable energy initiatives.

- Supporting community development projects.

- Conducting regular sustainability assessments.

- Creating transparency around impact initiatives.

Future of the Insurance Industry

Looking ahead, future of insurance industry remains poised for growth & transformation. Companies that adapt to current trends & embrace change will emerge as leaders within this competitive landscape.

Innovations across technology, customer experience strategies, & sustainability will coexist, reshaping overall direction of industry. As businesses navigate through uncertainties, aligning goals with demands of a dynamic marketplace becomes essential.

Key Future Predictions

- Increased adoption of artificial intelligence across various functions.

- Greater reliance on data-driven decision-making processes.

- Expansion of personalized coverage options.

- Heightened focus on cybersecurity & risk management measures.

- Integration of sustainable practices becoming a norm.

Trends in Claims Processing

In 2023, notable changes surrounding claims processing continue making headlines. Ease of claiming experience often dictates customer satisfaction; hence, companies are investing in technology to streamline this essential area.

Enhanced claims processing systems allow for quicker turnaround times, improved accuracy, & reduced potential for fraud. Innovations such as AI-driven claims assessment tools help ensure that processes remain efficient while providing a seamless experience for clients.

Innovative Claims Processing Techniques

- Implementation of AI for quick claims assessments.

- Utilization of mobile apps for real-time updates.

- Introduction of self-service options for claims management.

- Adoption of video-based claims submissions for convenience.

- Integration of machine learning algorithms for predicting outcomes.

| Insurance Trends | Description |

|---|---|

| Digital Transformation | Utilizing technology for streamlined operations. |

| Customer-Centric Approaches | Prioritizing consumer needs & preferences. |

| Insurtech Growth | Innovations reshaping market dynamics. |

| Key Strategies | Focus Areas |

|---|---|

| Data Analytics | Improving risk assessment & pricing. |

| Cybersecurity | Protecting against digital threats. |

| Sustainability Efforts | Aligning with consumer values. |

“Innovation stands at forefront of insurance evolution, driving forces behind change that others must embrace.”

Conclusion

In 2023, the insurance industry is evolving rapidly, & it’s essential to stay updated. Key trends include enhanced digital transformation, a focus on customer experience, & the rise of sustainability initiatives. Embracing technologies like AI & big data can help companies offer better services. And another thing, understanding the importance of personalization in policies is crucial for meeting customer needs. For both consumers & providers, being aware of these shifts can lead to smarter decisions. Stay informed about these trends to navigate the changing landscape of the insurance industry effectively!