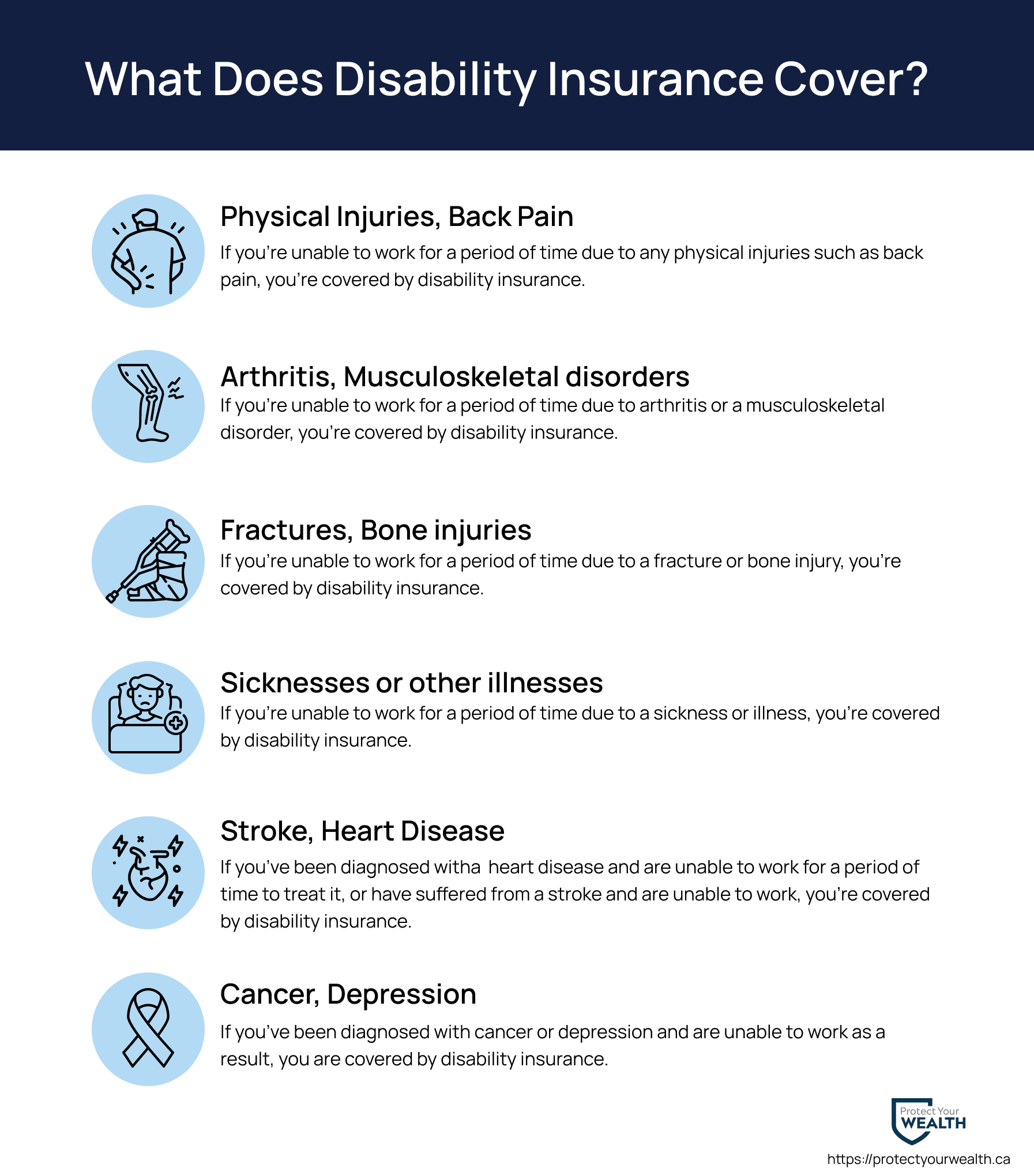

Disability insurance serves as a crucial financial safety net for individuals unable to work due to illness or injury. It provides a percentage of your income, helping cover essential expenses such as housing, medical bills, & daily living costs. Policies vary widely, including short-term & long-term options, making it important to assess your needs & budget when choosing a plan. Understanding the benefits, eligibility requirements, & application process ensures you select the right coverage, safeguarding your financial stability during challenging times.

Comprehensive Guide to Disability Insurance: Your Safety Net If Unable to Work. Discover our Comprehensive Guide to Disability Insurance, your essential safety net when you can’t work. Learn how to protect your income today!

Understanding Disability Insurance

Disability insurance serves as a crucial safeguard against unforeseen circumstances impacting one’s ability to earn a living. **Disability insurance** provides financial stability during hardships like serious illnesses or accidents that prevent working. Individuals must grasp nuances around this coverage, including policy types, eligibility criteria, & various benefits. Throughout my journey, I encountered situations where understanding this insurance played a vital role in ensuring my safety net was secure.

What Types of Disability Insurance Exist?

Individuals considering **disability insurance** should know various types available in market. Primarily, policies fall into short-term & long-term categories. Short-term policies typically cover a brief duration, such as three to six months. These plans are ideal for temporary disabilities, allowing individuals to recover & return work quickly.

Long-term disability insurance extends coverage for several years or even until retirement age. This form of insurance becomes vital for those facing chronic conditions or significant injuries that require lengthy recovery periods. Depending on specific circumstances, people may choose policies best suited for needs & risks.

Another variation includes group versus individual policies. Group policies often provide coverage as part of an employee benefits package. In a different context, individual policies allow individuals greater customization, though often at a higher premium. Each type serves your unique requirements.

Eligibility Criteria for Disability Insurance

Determining eligibility constitutes one of most significant factors when pursuing **disability insurance**. Insurers typically assess various elements before approving applications. Most notably, applicants must demonstrate a medical condition causing substantial impairment in performing job duties.

And another thing, each policy may require certain minimum work history, ensuring individuals have contributed enough into **disability insurance** system. Variances in requirements exist among providers, necessitating thorough research. Factors affecting eligibility include duration of coverage, nature of disability, & job responsibilities.

Generally, younger individuals working in less hazardous occupations may find it easier securing coverage. Be that as it may, seniors in physically demanding roles may face steeper challenges. Understanding personal circumstances eases navigation through application processes.

Key Benefits of Disability Insurance

One of most appealing aspects of **disability insurance** lies within numerous benefits offered. Financial assistance during tough times constitutes primary benefit, helping cover everyday expenses, such as mortgage payments, utility bills, & food costs. Maintaining stability allows individuals to focus on recovery rather than worrying about finances.

And another thing, some policies offer rehabilitation benefits, assisting individuals regain skills necessary for returning workforce. These benefits may include vocational training, counseling, & employment services. Such support significantly enhances chances reintegrating into workforce after prolonged absence.

On top of that, **disability insurance** may also provide coverage for specific living expenses, such as home modifications or specialized equipment. Establishing proper support systems ensures quality of life during recovery phases. These various benefits work cohesively, forming an essential aspect of financial planning.

Common Exclusions in Disability Insurance Policies

No policy comes without its exclusions, & knowing what these entail contributes to informed decision-making. Some common exclusions include pre-existing conditions that arise before purchasing coverage. Insurers frequently require individuals disclose any past issues, which may influence eligibility or negate claims altogether.

And another thing, certain occupational hazards may not qualify under **disability insurance**; for instance, high-risk jobs involving significant physical strain might face stricter conditions. Variances in definitions of total vs. partial disability create confusion among policyholders, necessitating careful examination of language used within agreements.

Mental health conditions present another gray area, often classified differently among insurers. Some policies provide specific coverage terms, whereas others may limit or exclude such claims. Awareness surrounding exclusions enables potential policyholders better prepare for unexpected outcomes.

How Premiums Are Determined

Premium costs differ vastly depending on individual circumstances & policy specifics. Typically, several factors come into play, including age, occupation, health history, & coverage amount desired. Younger, healthier individuals often benefit from lower premiums, whereas older applicants face higher costs due to increased risk.

Type of policy chosen also influences premium rates. Short-term coverage usually entails lower premiums compared long-term alternatives. And another thing, individuals opting for customization face higher costs, while group policies may provide lower rates through collective bargaining.

Finally, duration of waiting period before benefits commence plays a crucial role in determining premium. Lengthier waiting periods often result in reduced monthly costs, as insurers bear lower immediate financial responsibility. It’s vital to assess personal circumstances & compare multiple offers when selecting a policy.

Making Claims: Steps to Follow

Once you find yourself unable to work, understanding claims process becomes crucial. Filing a **disability insurance** claim often entails several steps. Initially, one must notify insurer promptly, adhering to outlined guidelines in policy. Delays or failures in notification may lead to complications later on.

Gathering requisite documentation represents another essential step in filing a claim. This may include medical records, proof of income, & any other information requested by provider. Thorough documentation streamlines process, setting a clearer path for potential approvals.

After submitting claim, maintaining open lines of communication with insurer remains vital. Individuals should routinely follow up on claim status, as insurers often possess workloads impacting processing times. Being proactive assists in navigating potential hurdles.

Selecting Right Disability Insurance Policy

Choosing a suitable **disability insurance** policy requires careful consideration of various factors. Begin by evaluating specific needs, deciding on necessary coverage amount. Assessing current financial obligations & estimating potential income loss assists in determining an appropriate figure that protects finances.

And don’t forget, conducting thorough research on providers offers valuable insights into reputation, customer service, & claim approval rates. Reading customer reviews, consulting with financial advisors, or even seeking referrals from family & friends can provide trusted recommendations.

Finally, prioritizing flexibility might serve well when selecting policies. Ensure that coverage can adapt to life changes, such as job transitions, income fluctuations, or family dynamics. A suitable policy evolves alongside your life, ensuring continued protection & security.

Cost Considerations: Balancing Coverage & Affordability

When weighing options for **disability insurance**, affordability plays a significant role in decision-making process. It’s vital to find a balance between adequate coverage & manageable costs. Beginning with evaluating budget ensures one can consistently pay premiums without financial strain.

Consider allocating a percentage of monthly income specifically towards securing this safety net. Analyzing overall financial situation allows for more informed budgeting decisions, ensuring necessary funds remain available. Professional advice may prove beneficial, as financial planners can develop tailored strategies for insurance planning.

And another thing, understanding potential tax implications of **disability insurance** benefits further informs decisions. Depending on circumstances, benefits may be taxable or tax-free. Ensuring clarity regarding these factors avoids surprises when claims become necessary, contributing to a smoother overall experience.

Table of Disability Insurance Policy Examples

| Insurance Provider | Policy Type | Monthly Premium | Benefit Period |

|---|---|---|---|

| Provider A | Short-Term | $150 | 6 Months |

| Provider B | Long-Term | $200 | 5 Years |

| Provider C | Short-Term | $175 | 3 Months |

Pros & Cons of Disability Insurance

As with any financial product, weighing advantages against drawbacks of **disability insurance** proves essential. Among the primary benefits, peace of mind ranks high. Individuals feel more secure knowing that they possess financial protection during unpredictable situations. This reassurance often enables focus back towards health & recovery.

Nonetheless, drawbacks exist. Many find premiums expensive, particularly when considering tight budgets or existing debt obligations. Individuals may hesitate purchasing coverage, ultimately impacting long-term security. Understanding personal financial constraints assists in evaluating affordability.

Another facet worthy of consideration concerns potential exclusions & limitations. Individuals might misinterpret terms, leading to dissatisfaction when claims arise. Carefully reading policies prior to commitment ensures clarity & awareness surrounding potential pitfalls.

Quotes Reflecting Importance of Disability Insurance

“**Disability insurance** represents an essential element of responsible financial planning, ensuring not only protection against income loss but also peace of mind when facing uncertainty.”

“Many view purchasing **disability insurance** merely as an additional expense, but this crucial safeguard represents an investment into your future security.”

“Understanding nuances of **disability insurance** empowers individuals, enabling informed decisions that ultimately protect livelihoods during challenging times.”

Understanding the Application Process

Typically, applying for **disability insurance** begins with selecting a suitable policy that aligns with your needs. Most applications require completion of detailed forms providing personal information alongside medical history. Insurers evaluate this information comprehensively, establishing a risk assessment to determine eligibility & premium rates.

Subsequently, individuals might be asked to undergo medical examinations or provide additional documentation validating current health conditions. This step ensures that insurers accurately gauge potential risks associated with coverage. Transparency during application enhances chances of obtaining desired policy.

After submitting necessary paperwork, individuals can often anticipate a waiting period before receiving a final decision. Insurers analyze submitted information in this timeframe, confirming whether coverage can be granted. Keeping documentation organized assists in expediting procedures, ensuring a smoother experience during what can prove a stressful time.

Tips for Managing Your Disability Insurance Policy

Once you’ve secured a **disability insurance** policy, managing it effectively becomes crucial for ensuring continued coverage. Begin by regularly reviewing your policy, scrutinizing benefits & limitations. Life circumstances change, & ensuring your coverage adapts remains essential for optimal protection.

Another vital strategy centers around keeping updated records of your health & any changes therein. This data may prove invaluable during claims processes, demonstrating that your condition warrants coverage according to your policy’s terms. And another thing, regularly communicating with insurer regarding any alterations ensures no surprises arise when seeking assistance.

Lastly, consider scheduling annual check-ins with a financial advisor. These consultations can help assess whether your current policy aligns with evolving financial needs & goals. This proactive mindset fosters a sense of security, helping navigate complexities surrounding **disability insurance** & overall financial well-being.

List of Resources for Understanding Disability Insurance

- National Association of Insurance Commissioners

- U.S. Social Security Administration

- Insurance Information Institute

- Consumer Financial Protection Bureau

- State Departments of Insurance

Comparative Analysis of Disability Insurance Plans

| Feature | Plan A | Plan B | Plan C |

|---|---|---|---|

| Monthly Premium | $180 | $220 | $200 |

| Coverage Amount | 60% of Income | 70% of Income | 65% of Income |

| Waiting Period | 30 Days | 60 Days | 15 Days |

Conclusion

In summary, having a robust understanding of disability insurance can be your best ally if you’re unable to work. This comprehensive guide has shown how crucial it is to find the right policy to secure your financial future. Remember, accidents & illnesses can happen to anyone, & being prepared can make all the difference. Take the time to explore your options, evaluate your needs, & ensure you have the right safety net in place. With the right disability insurance, you can focus on your recovery without the added stress of financial worries. Your peace of mind is worth it!